Discovery Case Study: Market Incentives for Off-Grid Renewable Energy

GDI’s incubation model follows four stages: Discover, Design, Build, and Exit. The following case study demonstrates the process of shaping an early stage Discovery effort from a broad idea into a defined, actionable strategy. It also illustrates how GDI explores adapting innovations from one initiative to apply to other areas and sectors; in this case, using development funds and a market incentives approach to de-risk private investment in high-impact markets.

Testing the effectiveness and scalability of new, innovative ideas requires resources that non-profit startups often lack. To help solve this challenge, GDI invests its unrestricted funding as needed to support the growth of ideas and organizations that push the boundaries of innovation and drive systems-level change. GDI has the flexibility to support efforts at any stage, from early-stage initiatives (Labor Mobility Partnerships) to in-house greenfield ideas borne from our engagements (read our Localizing Development blog series).

These efforts are vetted in our Discover phase, during which we assess the global and systems-level impact an initiative can generate, the strength and commitment of the team behind the initiative, and how GDI can effectively support expansion of the venture.

GDI recently engaged in a Discovery effort to explore the applicability of a market incentives model used for agricultural small- and medium-sized enterprise (agri-SME) by an existing GDI initiative, Aceli Africa, to the off-grid renewable energy sector (specifically for productive use such as solar powered cold storage, irrigation, and grain milling).

Building on an Existing Model: Market Incentives for Agri-SME Lending

Aceli Africa is a market incentive facility that unlocks private sector lending for inclusive agricultural enterprises in East Africa. Aceli aims to mobilize $600M in financing from commercial banks and impact investors to support agri-SMEs, with the goal of improving the livelihoods of over 1 million farm and SME workers by 2025.

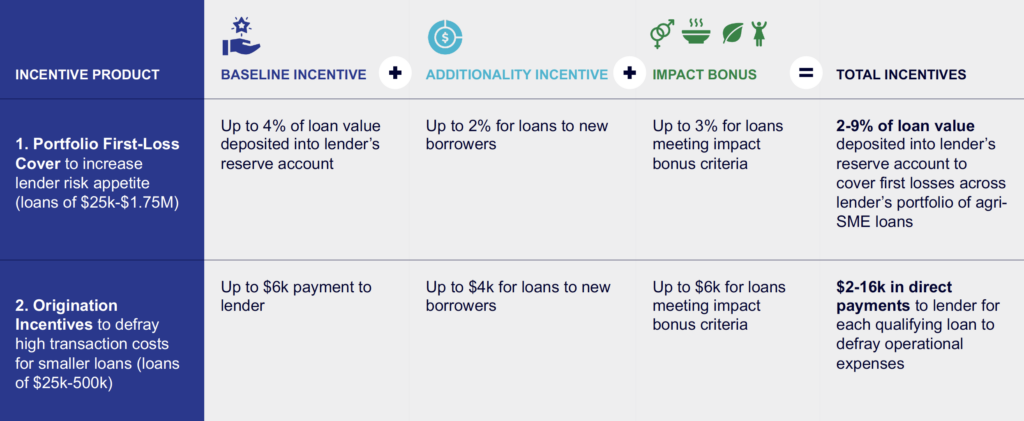

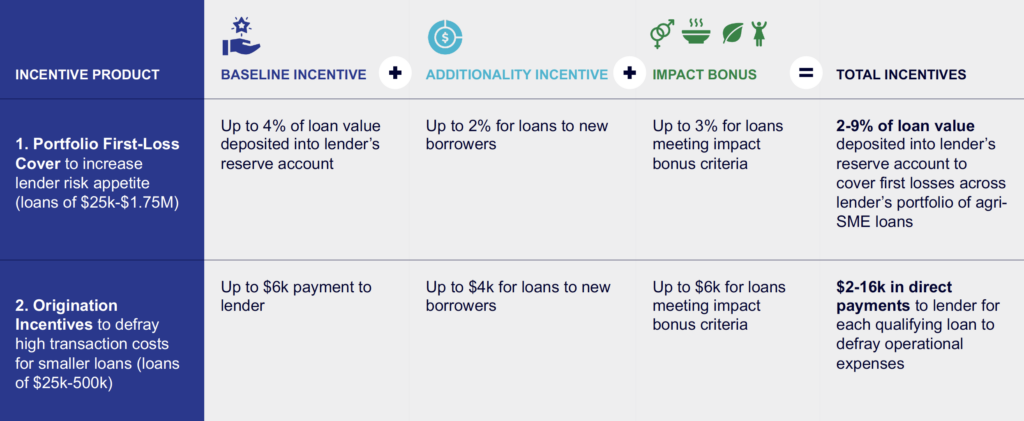

Launched in East Africa in 2020, Aceli has mobilized more than $74M in lending to 600 high-impact agri-SMEs (read Aceli’s Year 1 Learning Report to learn more about Aceli and its model). In order to de-risk lending and fill the existing finance gap for agri-SMEs in East Africa, Aceli offers the following incentives to lenders1:

Aceli’s success led to GDI and Aceli jointly exploring the applicability of these market incentives to unlock additional private sector capital for emerging sectors adjacent to agriculture. The high energy consumption of agriculture requires sustainable sources of energy, and off-grid renewable energy is one potential solution. However, the agriculture sector has been slow to adopt off-grid energy solutions based on perceptions of risk stemming from high capital needs coupled with very little data on returns.

We embarked on the effort to validate the market incentives approach and the use of development funds to de-risk private investment for off-grid renewable investments in the agriculture sector. We also hoped that our findings could be a blueprint to further extend the approach to other “risky” sectors, including childhood nutrition, water, sanitation, and transportation.

Exploring Applications for Off-Grid Renewable Energy

Our 12-week Discovery effort leveraged resources and expertise from both GDI and Aceli, with support from Juliane van Voorst to complete the analysis. We started by formulating an initial hypothesis:

Market incentives can enable opportunities for increased lending in the off-grid renewable energy sector.

We aimed to answer three strategic questions:

- Which segments (individual consumer, on-farm energy, SME in agriculture, or other segments) should the effort target?

- What aspects of the Aceli market incentives model would be directly applicable or adaptable for renewable energy?

- What is the best model to move the collective opportunity forward between GDI and Aceli, if the opportunity is validated?

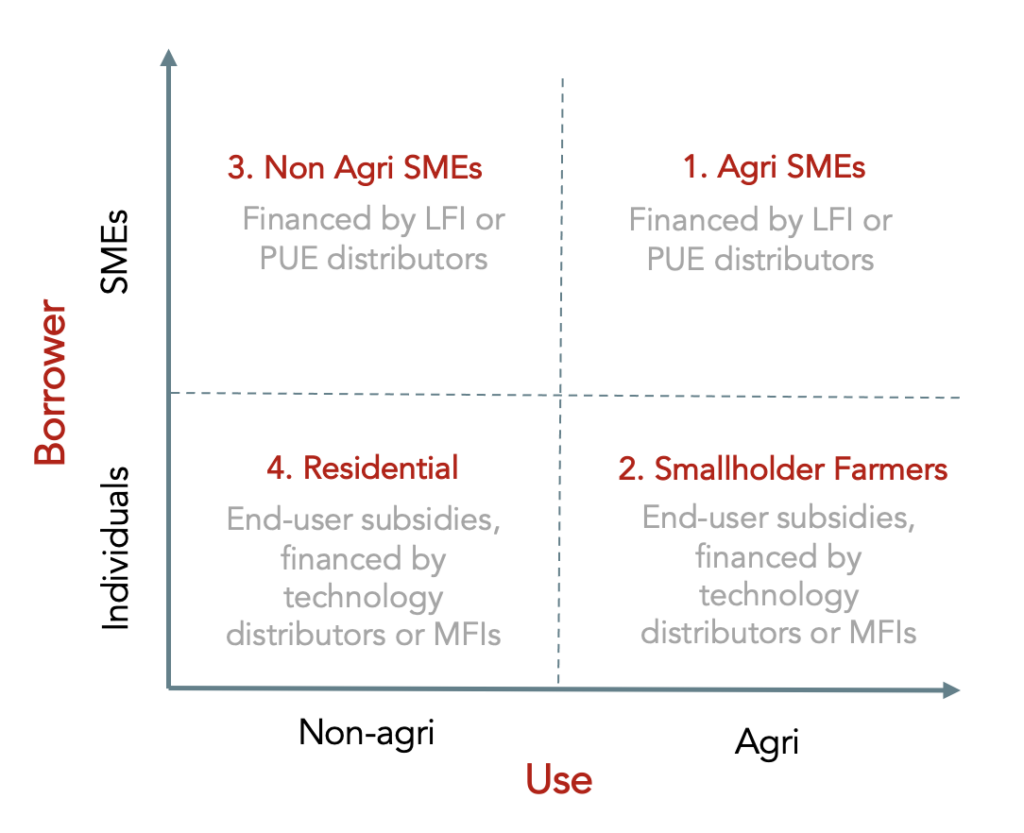

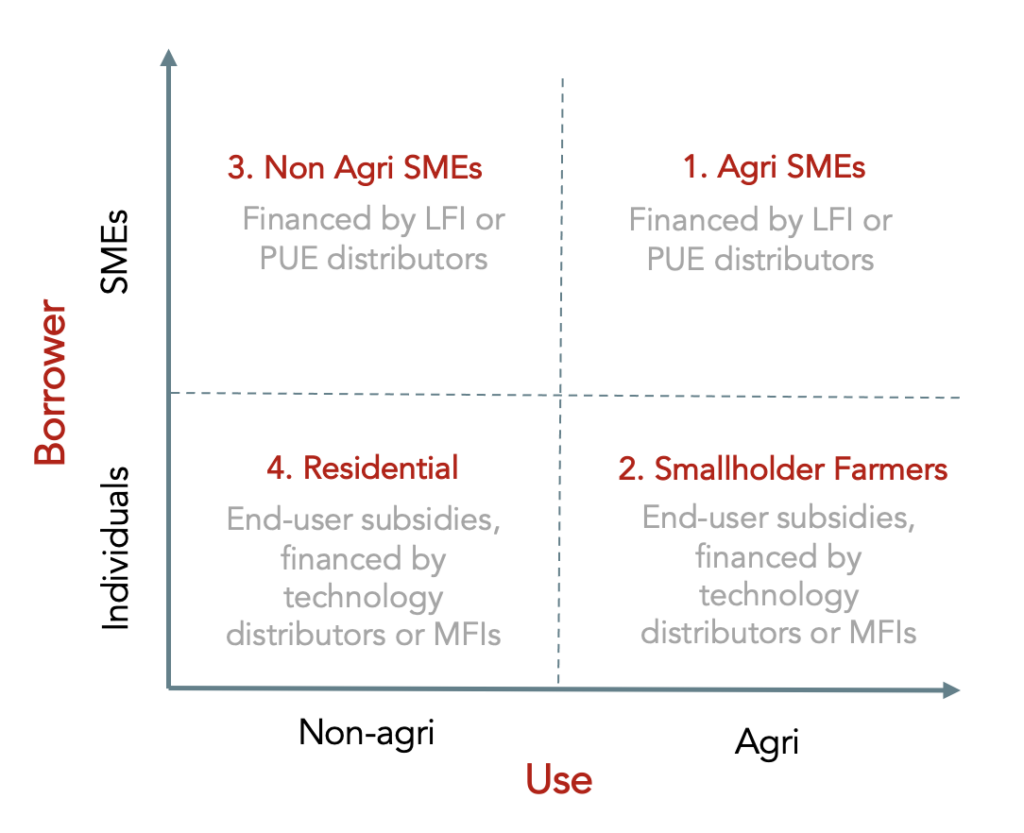

The first step was to identify broad market segments and determine priority areas. Since Aceli already works with agri-SMEs, we started our research with that segment and smallholder farmers, but also expanded to a broader range of non-agri-SMEs and individual customers.

The next few stages involved breaking down each segment to identify distinct market characteristics,2 conducting secondary research on current trends in off-grid energy for productive use equipment, identifying the market landscape of key stakeholders (technology providers, financial institutions and lenders, and ecosystem builders), and soliciting their views on the existing financial needs of the sector and applicability of market based incentives3.

Key Findings: Barriers & Opportunities

Through more than 30 stakeholder interviews and analyses of several sector reports, we identified three key findings:

First, other than residential and small retail SMEs, most market segments were in a nascent stage of using renewable energy-based equipment in their daily operations, and would each benefit from a different financing mechanism:

- Agri-SMEs and smallholder farmers would benefit from equipment such as cold-storage and irrigation, but face affordability issues – i.e. they don’t have the capital or the credit history to purchase these products. They are also the most readily addressable segment for piloting a market-based incentives approach.

- Commercial and industrial SMEs demand low-cost and consistent electricity, and are bankable customers, but the market faces financing issues and/or regulatory challenges.

- Health and education organizations typically don’t have high profit-revenue business models to back a cash flow based lending model, but could be supported through results-based financing models.

- Individuals and retail SMEs are the most evolved market segment and are heavily reliant on Pay-As-You-Go payment models.

Second, each stakeholder faced a unique set of barriers, but the common theme was the lack of local currency lending for renewable energy products in East Africa:

- International lenders found it challenging to lend in local currencies due to foreign exchange risks and small ticket sizes.

- Technology distributors could not access local currency due to high credit risk.

- Local Financial Institutions (LFIs) didn’t have the sector knowledge, the right lending product, or the risk appetite to make loans for off-grid renewable equipment.

Third, several market mechanisms already existed to catalyze additional funding for off-grid renewable energy. These included individual technology distributors or industry-level Special Purpose Vehicles4 to isolate financial risk, and Leasing Models to create more affordability through long-term cash flows. However, all of these faced challenges in either setting up or scaling.

Next Steps

With these findings, we crafted a strategy for Aceli Africa to leverage its existing network of LFIs to expand its lending and include agri-SMEs seeking financing for off-grid energy solutions. Aceli Africa plans to engage technology providers, lenders, and supporting organizations to mitigate barriers, such as determining the appropriate technologies and creating an enabling environment for off-grid renewable energy financing.

In addition, we also designed a new pathway to explore the viability of collaborative lending between international lenders and LFIs to increase local currency lending that may unlock additional financing for off-grid energy distributors. The design of this pathway is still in its early stages. It will require close cooperation with LFIs currently partnering with Aceli, and international lenders willing to work with LFIs to identify their barriers and create opportunities to collaborate.

Takeaways from this Discovery

Success at GDI often means expanding the impact of existing initiatives instead of creating new organizations, which inherently take time and carry startup risk. We believe that the market incentives model has high applicability for off-grid renewables. An outstanding question at the beginning of the Discovery was how we would move ahead with the findings. While Aceli and GDI are similar institutions in their purpose and intent, Aceli was specifically interested in how off-grid lending can be operationalized for Agri-SMEs, while GDI was interested in exploring other segments, beyond Agri-SME.

Our findings landed closer to the Agri-SME market segment. Given Aceli Africa already exists with established networks and strong sector adjacencies, the best approach for us was to partner with Aceli (rather than creating an off-grid energy financial intermediary) and encourage lenders to explore broader SME markets, while receiving consistent support and technical assistance. Aceli is defining its strategy around off-grid for Agri SMEs as part of a broader strategy to increase lending to underserved market segments.

In the meantime, GDI will continue to build on the findings of the pilot and broaden the scope of market incentives to other related sectors.

________________________

Footnotes

(1) Portfolio First-Loss Coverage offers lenders 2-8% first-loss coverage at a portfolio level for loans ranging from $25k-$1.5M; Origination Incentives compensates lenders for the lower revenues and higher operating costs of making smaller loans ($25k-500k) to early stage SMEs; Impact Bonus offer higher first-loss coverage and origination incentives for businesses that are gender inclusive, strengthen food security in Africa, or practice climate-smart agriculture.

(2) For e.g. non agri SMEs were further broken down into Solar C&I (commercial and industrial), public institutions such health and education related infrastructure, and small retail SMEs

(3) While the common theme across all interviews was to identify financing needs, we also asked targeted questions from each category of stakeholder. We gathered information on the business model of all technology providers and the market segment they prefer to serve. With lenders, we focused on their preferred ticket size, the market segments they invest in, and the status of their current investments. Ecosystem builders helped us with a more comprehensive view of the trends and needs in the sector, across each market segment.

(4) Special Purpose Vehicles set up by individual technology distributors enables them to separate their operating entity from the financial entity. Industry-level SPVs, on the other hand purchase receivables (money for products or services that have been offered but not yet been paid for) from multiple technology distributors which use the same underlying platform, bundle them based on their risk of being realized, and offer them as investment instruments to potential investors.

Testing the effectiveness and scalability of new, innovative ideas requires resources that non-profit startups often lack. To help solve this challenge, GDI invests its unrestricted funding as needed to support the growth of ideas and organizations that push the boundaries of innovation and drive systems-level change. GDI has the flexibility to support efforts at any stage, from early-stage initiatives (Labor Mobility Partnerships) to in-house greenfield ideas borne from our engagements (read our Localizing Development blog series).

These efforts are vetted in our Discover phase, during which we assess the global and systems-level impact an initiative can generate, the strength and commitment of the team behind the initiative, and how GDI can effectively support expansion of the venture.

GDI recently engaged in a Discovery effort to explore the applicability of a market incentives model used for agricultural small- and medium-sized enterprise (agri-SME) by an existing GDI initiative, Aceli Africa, to the off-grid renewable energy sector (specifically for productive use such as solar powered cold storage, irrigation, and grain milling).

Building on an Existing Model: Market Incentives for Agri-SME Lending

Aceli Africa is a market incentive facility that unlocks private sector lending for inclusive agricultural enterprises in East Africa. Aceli aims to mobilize $600M in financing from commercial banks and impact investors to support agri-SMEs, with the goal of improving the livelihoods of over 1 million farm and SME workers by 2025.

Launched in East Africa in 2020, Aceli has mobilized more than $74M in lending to 600 high-impact agri-SMEs (read Aceli’s Year 1 Learning Report to learn more about Aceli and its model). In order to de-risk lending and fill the existing finance gap for agri-SMEs in East Africa, Aceli offers the following incentives to lenders1:

Aceli’s success led to GDI and Aceli jointly exploring the applicability of these market incentives to unlock additional private sector capital for emerging sectors adjacent to agriculture. The high energy consumption of agriculture requires sustainable sources of energy, and off-grid renewable energy is one potential solution. However, the agriculture sector has been slow to adopt off-grid energy solutions based on perceptions of risk stemming from high capital needs coupled with very little data on returns.

We embarked on the effort to validate the market incentives approach and the use of development funds to de-risk private investment for off-grid renewable investments in the agriculture sector. We also hoped that our findings could be a blueprint to further extend the approach to other “risky” sectors, including childhood nutrition, water, sanitation, and transportation.

Exploring Applications for Off-Grid Renewable Energy

Our 12-week Discovery effort leveraged resources and expertise from both GDI and Aceli, with support from Juliane van Voorst to complete the analysis. We started by formulating an initial hypothesis:

Market incentives can enable opportunities for increased lending in the off-grid renewable energy sector.

We aimed to answer three strategic questions:

- Which segments (individual consumer, on-farm energy, SME in agriculture, or other segments) should the effort target?

- What aspects of the Aceli market incentives model would be directly applicable or adaptable for renewable energy?

- What is the best model to move the collective opportunity forward between GDI and Aceli, if the opportunity is validated?

The first step was to identify broad market segments and determine priority areas. Since Aceli already works with agri-SMEs, we started our research with that segment and smallholder farmers, but also expanded to a broader range of non-agri-SMEs and individual customers.

The next few stages involved breaking down each segment to identify distinct market characteristics,2 conducting secondary research on current trends in off-grid energy for productive use equipment, identifying the market landscape of key stakeholders (technology providers, financial institutions and lenders, and ecosystem builders), and soliciting their views on the existing financial needs of the sector and applicability of market based incentives3.

Key Findings: Barriers & Opportunities

Through more than 30 stakeholder interviews and analyses of several sector reports, we identified three key findings:

First, other than residential and small retail SMEs, most market segments were in a nascent stage of using renewable energy-based equipment in their daily operations, and would each benefit from a different financing mechanism:

- Agri-SMEs and smallholder farmers would benefit from equipment such as cold-storage and irrigation, but face affordability issues – i.e. they don’t have the capital or the credit history to purchase these products. They are also the most readily addressable segment for piloting a market-based incentives approach.

- Commercial and industrial SMEs demand low-cost and consistent electricity, and are bankable customers, but the market faces financing issues and/or regulatory challenges.

- Health and education organizations typically don’t have high profit-revenue business models to back a cash flow based lending model, but could be supported through results-based financing models.

- Individuals and retail SMEs are the most evolved market segment and are heavily reliant on Pay-As-You-Go payment models.

Second, each stakeholder faced a unique set of barriers, but the common theme was the lack of local currency lending for renewable energy products in East Africa:

- International lenders found it challenging to lend in local currencies due to foreign exchange risks and small ticket sizes.

- Technology distributors could not access local currency due to high credit risk.

- Local Financial Institutions (LFIs) didn’t have the sector knowledge, the right lending product, or the risk appetite to make loans for off-grid renewable equipment.

Third, several market mechanisms already existed to catalyze additional funding for off-grid renewable energy. These included individual technology distributors or industry-level Special Purpose Vehicles4 to isolate financial risk, and Leasing Models to create more affordability through long-term cash flows. However, all of these faced challenges in either setting up or scaling.

Next Steps

With these findings, we crafted a strategy for Aceli Africa to leverage its existing network of LFIs to expand its lending and include agri-SMEs seeking financing for off-grid energy solutions. Aceli Africa plans to engage technology providers, lenders, and supporting organizations to mitigate barriers, such as determining the appropriate technologies and creating an enabling environment for off-grid renewable energy financing.

In addition, we also designed a new pathway to explore the viability of collaborative lending between international lenders and LFIs to increase local currency lending that may unlock additional financing for off-grid energy distributors. The design of this pathway is still in its early stages. It will require close cooperation with LFIs currently partnering with Aceli, and international lenders willing to work with LFIs to identify their barriers and create opportunities to collaborate.

Takeaways from this Discovery

Success at GDI often means expanding the impact of existing initiatives instead of creating new organizations, which inherently take time and carry startup risk. We believe that the market incentives model has high applicability for off-grid renewables. An outstanding question at the beginning of the Discovery was how we would move ahead with the findings. While Aceli and GDI are similar institutions in their purpose and intent, Aceli was specifically interested in how off-grid lending can be operationalized for Agri-SMEs, while GDI was interested in exploring other segments, beyond Agri-SME.

Our findings landed closer to the Agri-SME market segment. Given Aceli Africa already exists with established networks and strong sector adjacencies, the best approach for us was to partner with Aceli (rather than creating an off-grid energy financial intermediary) and encourage lenders to explore broader SME markets, while receiving consistent support and technical assistance. Aceli is defining its strategy around off-grid for Agri SMEs as part of a broader strategy to increase lending to underserved market segments.

In the meantime, GDI will continue to build on the findings of the pilot and broaden the scope of market incentives to other related sectors.

________________________

Footnotes

(1) Portfolio First-Loss Coverage offers lenders 2-8% first-loss coverage at a portfolio level for loans ranging from $25k-$1.5M; Origination Incentives compensates lenders for the lower revenues and higher operating costs of making smaller loans ($25k-500k) to early stage SMEs; Impact Bonus offer higher first-loss coverage and origination incentives for businesses that are gender inclusive, strengthen food security in Africa, or practice climate-smart agriculture.

(2) For e.g. non agri SMEs were further broken down into Solar C&I (commercial and industrial), public institutions such health and education related infrastructure, and small retail SMEs

(3) While the common theme across all interviews was to identify financing needs, we also asked targeted questions from each category of stakeholder. We gathered information on the business model of all technology providers and the market segment they prefer to serve. With lenders, we focused on their preferred ticket size, the market segments they invest in, and the status of their current investments. Ecosystem builders helped us with a more comprehensive view of the trends and needs in the sector, across each market segment.

(4) Special Purpose Vehicles set up by individual technology distributors enables them to separate their operating entity from the financial entity. Industry-level SPVs, on the other hand purchase receivables (money for products or services that have been offered but not yet been paid for) from multiple technology distributors which use the same underlying platform, bundle them based on their risk of being realized, and offer them as investment instruments to potential investors.