Guidance for Non-Profit Board Management – Part 1: Finance

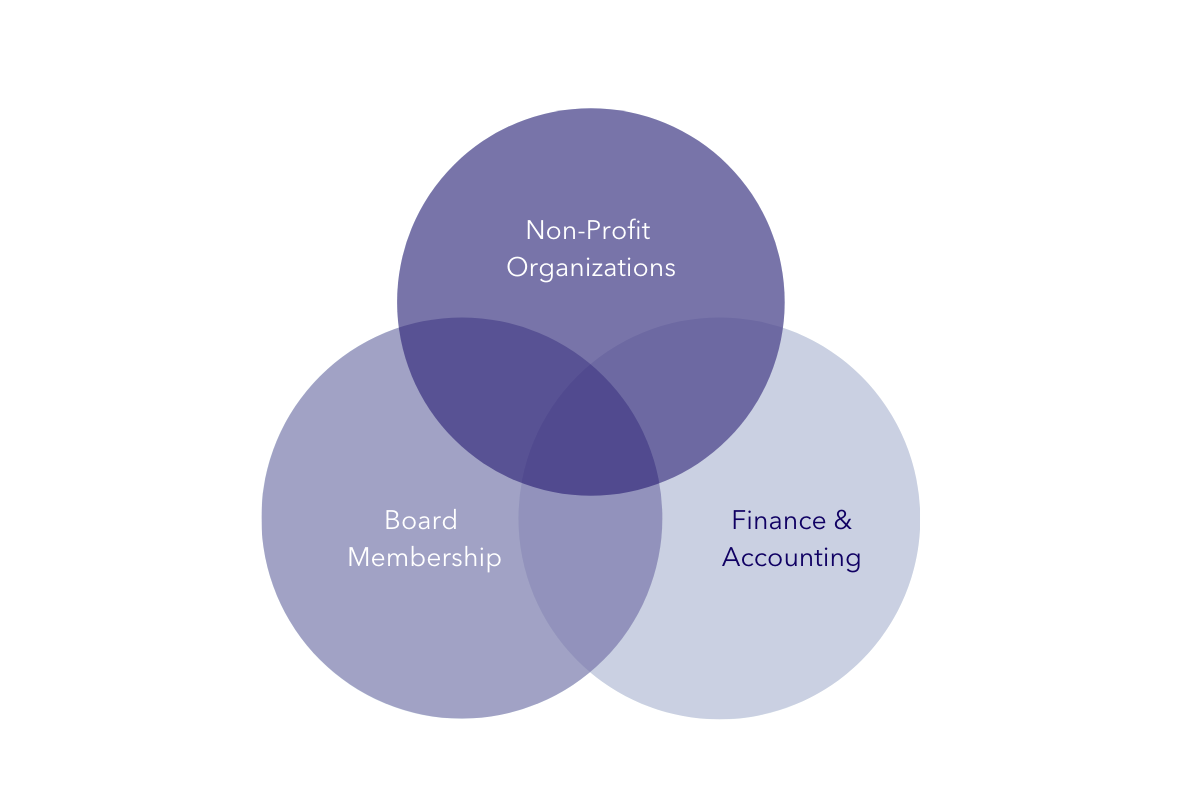

An essential element for the success of a new non-profit organization is effective board oversight and engagement. In GDI’s experience, one of the more challenging areas for new non-profit boards is understanding the most effective ways to provide appropriate financial oversight. Every strong board includes board members with a range of backgrounds, perspectives, and skills. However, particularly in early-stage boards, it can be rare to find experienced board members that bring a full complement of non-profit, finance, and accounting experience. While it is not unusual to find board members with backgrounds in one or two of these areas, it is significantly less common to find board members with all three.

As a result, early stage boards often aren’t fully confident in their financial oversight.

To support boards, particularly at early stage initiatives, GDI often shares guidance on the scope of finance and accounting oversight, and specific recommendations on the questions boards should ask of management to ensure they are getting the information they need. To encourage the good work of all early stage board members, we share that guidance here.

Board configurations of how they manage finance and accounting can vary widely. Particularly on newer and smaller boards, the board as a whole may provide finance and accounting oversight. While we will break our guidance out into two separate areas – Finance, detailed in this blog, and Accounting, which we cover here – that may be staffed by unique committees, the approach to delegating these activities is less important than ensuring that this oversight occurs.

Board’s Role in Financial Review

A key role of the board is proactive oversight of financial and accounting activities of the organization. While management has the responsibility to ensure the accuracy of the financial statements and compliance with laws, regulations and agreements, it is the board’s responsibility — either as a whole or via committees — to carry out due diligence by evaluating information from the staff and external parties, identifying any concerns, and providing guidance.

Finance Committee Purpose

Generally any Finance Committee serves three major purposes in the organization:

- Setting direction for, reviewing, and recommending the approval of the annual budget

- Conducting regular review of the organization’s financial position and reviewing proposed corrective action in any areas of concern

- Providing feedback and guidance on other finance and compliance-related activities, such as tax filings, investment policies, major changes to accounting policies or platforms, reserve target and utilization strategies, reviewing unusual transactions or high dollar value procurements, and assessing the adequacy of the finance, accounting, and compliance functions within the organization

While many early stage boards may philosophically understand these roles, they may be less clear how to conduct these activities in a way that provides real value to both the board and the organization. We invite boards to consider some of these questions and areas of focus below.

Review of the Annual Budget

The annual budget should be prepared by staff and approved by the board prior to the start of each year. Budgets should reflect projected income and expenditures for the year, providing prior year comparison information whenever practical.

Some key questions for the Finance Committee to consider in the review of the budget may include:

Overall

- Which line items have significant variance from the prior year budget, and why?

- How does this budget compare to the prior year budget in total size?

- How accurate have prior year budgets been? What budget components in particular have been less accurate in previous years, and why? How did that influence the proposed budget?

- Does the budget have a year-end break-even projection or net gain? If not, how will the projected deficit be funded?

- What is the indirect cost rate? Is it appropriate for the organization in light of the organization’s risk tolerance, complexity of operations, and donor allowances?

Income

- What kind of assumptions are made about unsecured income? How are assumptions about the likelihood of new income sources reflected, and how do they impact the income projections in the proposed budget? (1)

- Is income concentrated in a small number of awards?

- When are major awards ending? Are there additional funding sources identified to take their place?

Expenses

- Are funds included to invest in areas where there are concerns about organizational performance?

- What methods are used to project significant costs?

- How are cost escalation factors determined?

- Are any unusual capital, IT, communications, or other investments required?

- Are there expenses that can be cut or delayed if income projections are not met?

In some cases, a cash flow projection is also provided with the budget as additional background. While cash flow projections generally would not be approved by the board, it may provide assurance that management has an appropriate plan in place to ensure they can meet their projected financial obligations on a month-to-month basis.

Review of Financial Position

The Finance Committee should conduct a regular review of the financial position of the organization with a view toward identifying problems early and reviewing proposed corrective actions. This monitoring includes a review of the organization’s cash position, actual income and expenses against the board approved budget, consideration of any expected budget variance, and ongoing assessment of the likelihood of new income sources being secured. Modest variance from the proposed budget should be expected. (2)

Some key questions for the Finance Committee to consider in the review of the organization’s financial position may include:

- Are there areas of significant variance from the budget? If yes, will these areas of variance be temporary or long term? Will this variance have an impact on our ability to meet our mission?

- Are budgeted income assumptions still reasonable?

- Have new critical expenses been identified since the budget was approved? How will these be funded?

- Have new funding sources been identified that were not included in the original budget? If yes, should new investments be made?

- Does the organization have adequate cash on hand to meet its obligations? If not, how can this be managed or resolved?

Other Activities

The last set of other activities may rest with the Finance Committee, or may be managed by the board as a whole. These areas may include, but are not limited to:

Reviewing investment strategies

- Does the organization have significant excess unrestricted cash? If yes, how should those funds be invested to balance potential risk of loss while maximizing earnings?

Considering changes to technical accounting platforms

- What are the implications of changing accounting platforms? Are there risks associated with the transition period while new procedures are developed and adopted? Does the system provide or enhance key controls?

Reviewing significant or unusual transactions

- Does the recording of this transaction indicate broader concerns that should be addressed (for example, if there was a write-off of a significant receivable, would that indicate concerns about donor or customer reliability, or the quality of projections)? Should the organization seek an outside opinion, such as the auditors, prior to finalizing the transaction?

Reviewing high dollar value procurements (generally this is a management function, but the board may elect to set a dollar threshold where the board or a delegate reviews procurements)

- In light of the total costs, is the board assured that the organization has reasonably considered an appropriate range of relevant options and selected the option that provides the best value for money?

Reviewing and/or approving organizational tax filings (3)

- Does the tax filing appropriately represent the organization’s mission and key activities? Is there information in the tax filing that is unexpected or may cause misunderstanding or organizational risks (e.g. is there the appearance of excessive compensation rates that may cause concerns when publicly disclosed).

Reviewing reserve targets and utilization strategies

- How much unrestricted funding should the organization accumulate and maintain? What are the most likely sources of unrestricted funding? When and how should unrestricted funding be used?

Considering major changes to finance or accounting policy

- Do proposed changes create new risks to the organization, or potentially undermine key controls?

Approving organizational loans or lines of credit

- What is the purpose of the loan or line of credit? How will the organization repay this debt? How has the organization ensured that it is getting the most appropriate/cost effective loan or line of credit for its needs?

Approving the opening of bank or investment accounts

- Who will have access to this account and what is its purpose? Who will have signatory authority? How will this account be tracked to ensure transparency and appropriate use?

Reviewing conflicts of interest

- What is the actual or perceived conflict of interest? Is it in the organization’s best interest to proceed in light of this? What other options have been considered or could be considered? Does this create unique risk to the organization?

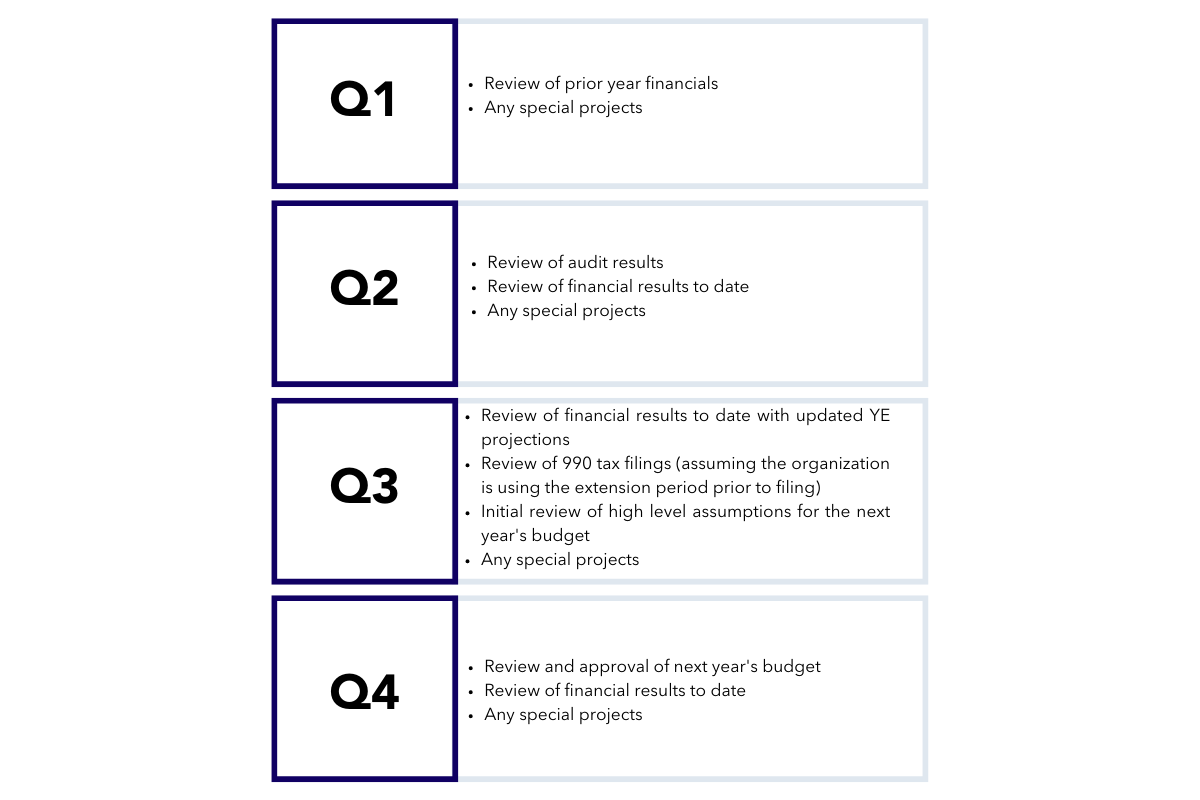

The Governance Finance and Accounting Calendar

To help board’s fulfill their role, we recommend that boards create an annual calendar for finance activities, with major activities pre-designated for specific board meetings. For example, if a board has quarterly meetings, it might design its calendar as follows:

Ongoing Management

Early investment in developing governance discipline in oversight of the finance and accounting function can pay long term dividends to new and growing organizations. Boards are able to more effectively engage in understanding the challenges and unique opportunities of the organization. The Executive Director and finance staff benefit from additional insights and inquiry, ensuring rigor in their work. And the organization as a whole is protected, ensuring its long term financial sustainability and success. We invite early boards to consider this guidance, and where appropriate use it as a guide to discuss with executive directors how they can best shape the organization and provide value through financial oversight.

________________________

Footnotes

(1) We’ve seen a number of approaches to budget projections of unsecured funding. At GDI we categorize budget income as Committed (funds are obligated through a signed agreement), High Confidence (funds are not fully committed, however specific donors have been identified, proposals have been submitted, and the donor has informally signaled that they intend to fund the award), Medium Confidence (specific donors have been identified and signaled interest in this area of work but development of a full proposal is still pending) or Low Confidence (funds are speculative).

(2) The board should determine in advance the amount of total variance that will be tolerated before a new budget must be submitted to review and approved by the full board (for example, a board may determine that any projected variance in excess of 30% of the total income or expense budget must be submitted to the full board for consideration and approval).

(3) IRS guidance recommends at a minimum that 990 tax filings are circulated to the board prior to submission.