Guidance for Non-Profit Board Management – Part 2: Auditing

Audit Committee Purpose

The Audit Committee’s primary role is to oversee the audit process, including identifying the scope of the audit, selecting the auditor, considering concerns reported by the auditor (1), recommending board approval of the audit, and reviewing and approving corrective action plans. Best practice requires the board to have an active role in selecting, engaging, and corresponding with the auditors to confirm the audit scope and review any significant audit results.

In addition, the committee should review the organization’s internal controls to ensure adequate processes and plans are in place to prevent fraud and errors and to serve as the confidential designated resource for staff with reportable concerns of potential fraud or financial mismanagement.

As noted in our previous article, board configurations of how they manage finance and accounting can vary widely. Particularly on newer and smaller boards, the board as a whole may provide finance and accounting oversight. While these articles break financial and accounting management into two separate areas that may be staffed by unique committees, the approach to delegating these activities is less important than ensuring that this oversight occurs.

Auditor Selection

While there is a range of information available online regarding how a board should select an auditor, in our experience this advice is too general to be truly helpful for boards that need to select the best auditor for their organization. While we concur with generally available advice that auditors should be qualified and have experience in the organization’s industry, this type of guidance is often self-evident and rarely feels like it differentiates auditor proposals. We’ll spend some time here walking through the advice we give to initiative boards as they go through this auditor selection process.

Role of the Auditor

Many think of the external auditor like an adversarial prosecutor. They are viewed as an outside party who is paid to poke around and figure out everything you are doing wrong. While it certainly is the role of the auditor to ensure that the financial statements accurately reflect the financial position of the organization and identify potential weaknesses and areas for improvement, they also can be a valuable partner to both staff and the board. A good auditor can provide significant insight, particularly to new, growing, and complex organizations that benefit from a partner to provide feedback on complex accounting decisions and/or topics.

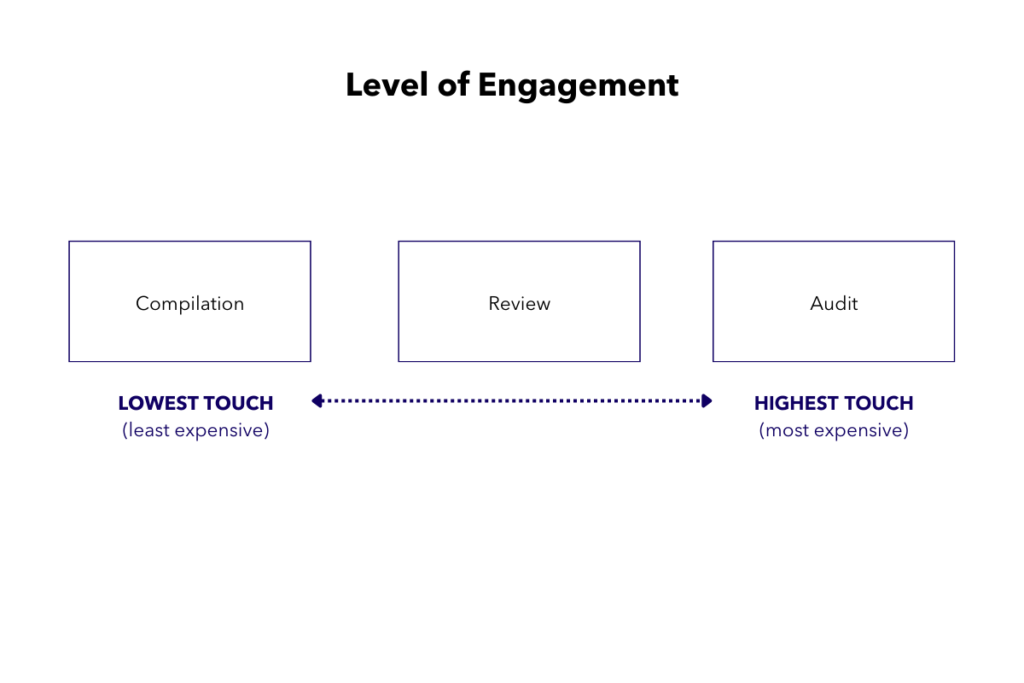

Level of Engagement

The first stage of engaging an audit firm is to determine their scope of work. For many organizations this is a regular audit, but young organizations may find it more sensible for the auditors to conduct a review or a compilation instead.

There are several key differences between an audit, a review, and compilation, although the exact scope may vary.

- A compilation results in a financial statement prepared by an auditor based on information provided by the organization. In a compilation, the auditors do not verify the information provided.

- In a review the auditor conducts limited testing to evaluate whether the information contained within the financial statements is materially correct. This type of engagement provides a more limited level of assurance.

- In an audit the auditor confirms the information in the financial statements to ensure that it is materially correct. This confirmation includes activities such as: review of backup documentation; confirmation of balances with third parties, walk through and other tests of internal controls; and other activities as appropriate. An audit provides the highest level of assurance.

In summary, the primary differences between an audit, a review, and a compilation are:

- Level of assurance.

- Extent of reliance on management for information, vs. validating information independently.

- The amount of work performed, and the corresponding price.

Organizations should determine the most appropriate type of engagement for their individual needs based on:

- Requirements of the state (2) where they are registered

- Donor requirements

- Board risk tolerance

- Concerns about fraud or financial misstatement risk either due to the nature or location of work

- Organizational size (organizations with expenditures of less than $3M often do not require a full audit unless it meets one of the criteria above)

- Whether they expect to need significant auditor advice during the year (an audit firm normally limits this support to certain types of engagements)

- Any time sensitivities (both availability of staff time, and deadlines for the auditors report)

- Price

Selection Criteria

After selecting the correct scope of activities for the audit firm, we find the most challenging element of auditor selection at newer/smaller organizations is:

- Identifying appropriate firms to respond to a Request For Proposals (RFP)

- Differentiating between firm’s responses (beyond pricing)

Identifying appropriate firms

We have been in many auditor selection discussions with small organizations where boards recommended that we reach out to the “top five” audit firms for proposals. Rarely does that result in an adequate response of proposals relevant to the organization. Small organizations are rarely an appropriate or cost effective fit for top tier firms. As a result, those firms frequently either decline to prepare a proposal, or submit proposals that are outside of the organization’s budget.

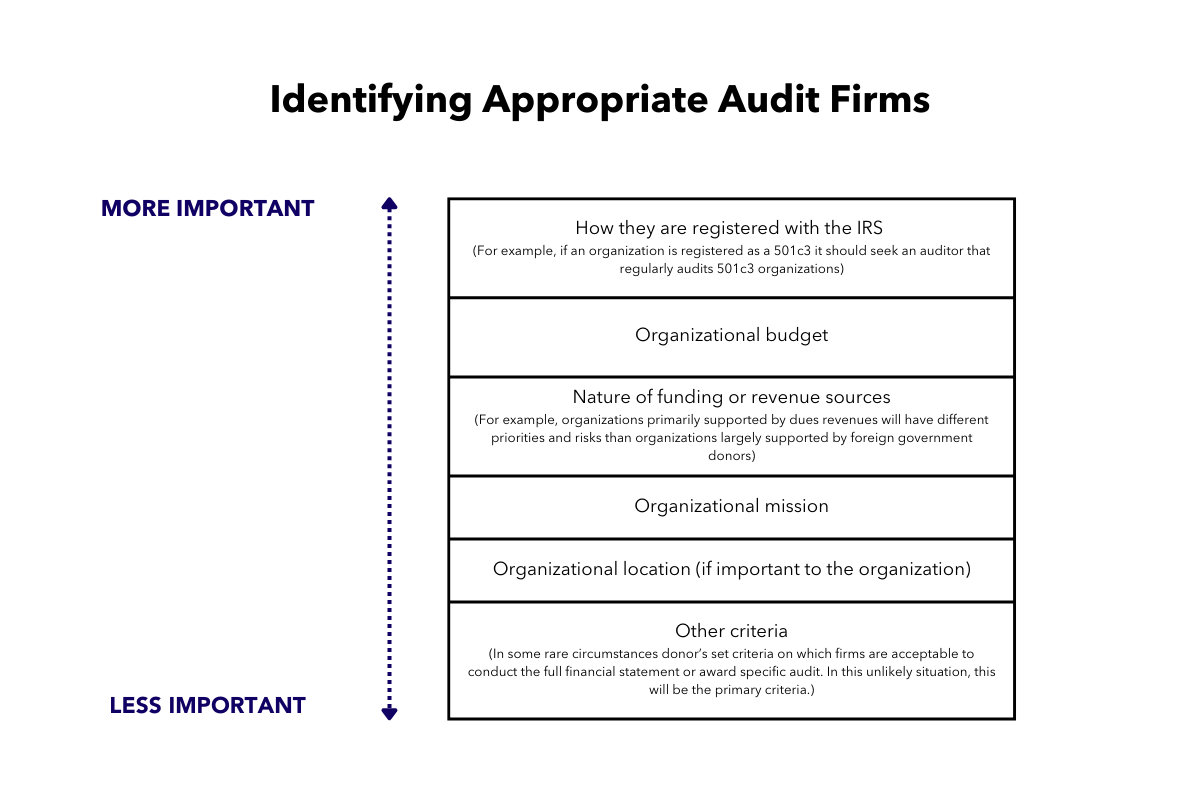

Instead, organizations should actively identify and target firms that have expertise in their industry at their size. These firms are significantly more likely to provide cost appropriate proposals and the specialized expertise to provide quick and accurate guidance throughout the year. Organizations similar to your organization likely have similar characteristics in the following areas:

For organizations that are less familiar with high quality auditors that specialize in their area of work, we recommend the following:

- Ask your accounting services provider for recommendations

- Look at names of the firms submitting 990 tax forms for 501c3 organizations that you view as similar to your own in the categories identified above. Since organizations often have the same firm completing both tax filings and audits, this can be a good indicator of who the audit is. The name of the submitting firm can be found at the bottom of the first page of these documents, which are public record. If the review of tax filings for similar organizations frequently returns the names of a few firms, that is likely an indication of appropriate specialized expertise or focus of that firm.

- Reach out to similar organizations and ask for recommendations

Further narrowing the list of firms and reviewing proposals

As part of the selection process, we recommend boards also consider the following questions which will help guide them to firms that are relevant to their specific organization’s needs and priorities.

- Is it preferable to find an audit firm that focuses on deep non-profit knowledge, or to find a firm that has broader knowledge of parallel business areas?

- Is it better for the organization to be a “larger fish” for a smaller audit firm, or to be a “smaller fish” to leverage more widespread name recognition? While many organizations believe the name recognition of their auditors is critical, we find this is true less often than organizations expect. Generally, it is only appropriate to consider the name recognition of the audit firm if the organization has significant ($10M+) international donor funds that may not be familiar with specialized firms in the US, or if the organization expects to scale very quickly.

- Would the organization gain significant value from a firm with broader non-audit client services, and if yes, which services are prioritized (e.g. a risk management practice)?

- Is the organization expected to go through significant growth or evolution? If yes, how will you balance the needs or the organization now with the needs of the organization in the future?

- How focused is the audit firm on providing advice throughout the year and how important is that to the organization in the context of the price proposal?

We generally recommend that organizations request proposals from approximately five firms to ensure they receive adequate response.

Interviewing Audit Firms

After the review of proposals, the list of potential candidates should be narrowed to two or three prospective firms and the audit committee should interview relevant candidates.

Generally we find 60-90 minutes is appropriate for these interviews. We encourage relevant finance or accounting leadership to attend these meetings as observers who both take notes and can also answer any questions that may come up in the discussion.

The first 15 minutes or so of the meeting will likely consist of the firm providing an overview of their proposal and qualifications. We recommend boards ask questions similar to the ones below to get a sense of the firm.

Background

- Describe your firm’s experience working with similar organizations.

- What areas will you be most focused on during the audit? How will you design your audit plan?

- Describe your approach to working with staff.

- Describe your approach to resolving disagreements with management.

- Why do you think we would be a good client for you? How do we fit within your larger business strategy and market approach?

Advisory

- What industry trends are you discussing with boards to ensure that they are effectively planning for the future?

- What common challenges have you seen in organizations like ours? Have you seen or made any creative recommendations on how to resolve those challenges?

- When you think about two or three of your clients that are most similar to us, do you see themes in major risk areas? If yes, how do you advise those organizations to manage that risk?

- From your perspective what are the best ways for improving the internal controls of a new organization such as ours (if relevant)?

- Do you provide client education opportunities for all of your clients outside of the audit (e.g. newsletters, webinars, etc. on topics of interest to your client community)? If yes, what types of areas do these cover?

Organization Specific

- Describe your experience working with organizations funded with donors similar to ours.

- Describe your experience working with organizations that work in our specific mission area.

- Describe your experience meeting and of our other organization-specific needs (e.g. specialized audits required by donors, uniquely compressed timeframes for audit results, etc)

A Cautionary Note

During audit firm interviews, the firm will be attempting to sell you on their services. In particular, it’s not infrequent for boards to ask if the audit firm can also do additional scopes of work during the interview process. These additional activities may be anything from designing a risk management plan to auditing subawardees. While many firms can do this, boards should be particularly careful to consider what is included in the price vs. what would be at an additional cost and scoped out separately. We’ve seen several boards get tripped up in evaluating responses when this occurs.

Boards should take care to ensure their questions are limited to the scope of the actual audit as described in the RFP to ensure they are comparing apples to apples throughout the process.

Conducting References on Audit Firms

Conducting references should be a regular part of any auditor procurement. References should cover a range of general topics, and questions specific to your organization. These may include questions such as:

- Describe your overall satisfaction with your audit experience.

- Is your audit partner available to you when you have questions? Are you satisfied with the accessibility and timeliness of responses from your auditors when you seek advice both during the audit and throughout the year?

- Share your assessment on the logistics of the audit. Were the auditors organized, timely, and easy to work with?

- Did your auditors offer relevant advice or guidance on how to strengthen your organization during the audit process?

- Were the final fees in line with your expectations from the proposal? If not, what changed?

- Were the auditors able to meet agreed upon timelines?

- Were the auditors adequately familiar with your unique industry and business model?

Audit

Audit Timing

Except in unique circumstances, audits should generally be conducted and completed within six months of the close of the fiscal year.

Audit Committee Engagement with the Auditors

The committee, or its delegate, should meet with the auditor prior to the engagement to confirm the scope of the work and highlight any potential areas of concern. At the conclusion of the audit, the committee should meet again with the auditors to discuss the results of the audit and any findings or concerns noted by the auditors.

Some key questions for the Finance and Audit Committee to consider in meeting with the auditors following the conclusion of the audit may include:

- Were you provided with all of the information you requested? Do you have any reason to believe that information was withheld from you or that management representations were incorrect?

- Did you observe any areas of serious concern over the internal controls environment?

- Were there any significant changes in the financial statements from the previous year? In your opinion does this cause significant concern?

- Were there any disagreements regarding accounting, auditing, or reporting matters between you and management? If so, how were they resolved?

- Are you satisfied with the organization’s ability to continue as a “going concern”?

- Were any weaknesses identified in the prior year management letter adequately resolved?

- What is your general assessment of the appropriateness of the organization’s finance and accounting staff and systems? What improvements would you recommend?

- Are there any unresolved matters?

- Are you aware of any proposed changes in the accounting principles, the law, or the regulatory environment that the organization should consider in its planning?

Closing the Audit

There are two components for the close of the audit

- Review of the management response

- Acceptance of the audit

The Finance and Audit Committee should review the management response to any issues identified by the auditors in the management letter. Staff responses to these recommendations should be adequately detailed to provide confidence that any changes to policy or procedure will be implemented efficiently and in full.

The committee will also present to the full board a recommendation to accept the audit and, depending on the configuration of the board, will either request approval by the full board, or will approve on the board’s behalf.

Partnering in Audit Management

Managing and engaging the auditors is one of the most important financial oversight tools a board has, and best practice requires active board participation in auditor selection and oversight. A good working relationship with a high quality auditor has the potential to create significant value for both the organization and the board. We encourage boards to discuss with their Executive Director many of the issues above, including organizational priorities for the auditor, and how staff hope to partner with external auditors to ensure strong overall financial management of the organization.

________________________

Footnotes

(1) Generally the audit firm also serves as the tax preparer, so the selection of a firm to conduct the audit and prepare relevant tax returns is often done through a consolidated selection process.

(2) Organizations will be well suited to discuss state specific requirements for audits with potential audit partners. That said, websites like this that aggregate requirements by state can often serve as a useful starting point to guide an organization’s understanding, although third party website information should always be validated.