The 25 Most Responsible Asset Allocators – GDI and partners release new leaders list

No sensible asset allocator would willingly invest in companies that pollute the environment, exploit labor, or operate unethically. This is especially true for global sovereign wealth funds (SWF) and government pension funds (GPF) that represent a significant share of the world’s $70 trillion in institutional investor assets. Many have begun incorporating environmental, social, and governance (ESG) risk metrics into their portfolio selection process. However, this trend, while promising, is far from universal, and the total amount of capital deployed based on responsible investment practices remains far below its potential.

No sensible asset allocator would willingly invest in companies that pollute the environment, exploit labor, or operate unethically. This is especially true for global sovereign wealth funds (SWF) and government pension funds (GPF) that represent a significant share of the world’s $70 trillion in institutional investor assets. Many have begun incorporating environmental, social, and governance (ESG) risk metrics into their portfolio selection process. However, this trend, while promising, is far from universal, and the total amount of capital deployed based on responsible investment practices remains far below its potential.

The newly released Bretton Woods II Leaders List: The 25 Most Responsible Asset Allocators is grounded in the realization that for long-term institutions, investing sustainably is not only the right thing to do but also the smart thing to do.

GDI collaborated with New America, Dalberg, and the Fletcher School at Tufts on the Leaders List, as part of the Responsible Asset Allocators Initiative (RAAI) at Bretton Woods II. Bretton Woods II operates within New America to help large asset allocators reduce risks and optimize returns through strategic investments in responsible investing and sustainable development.

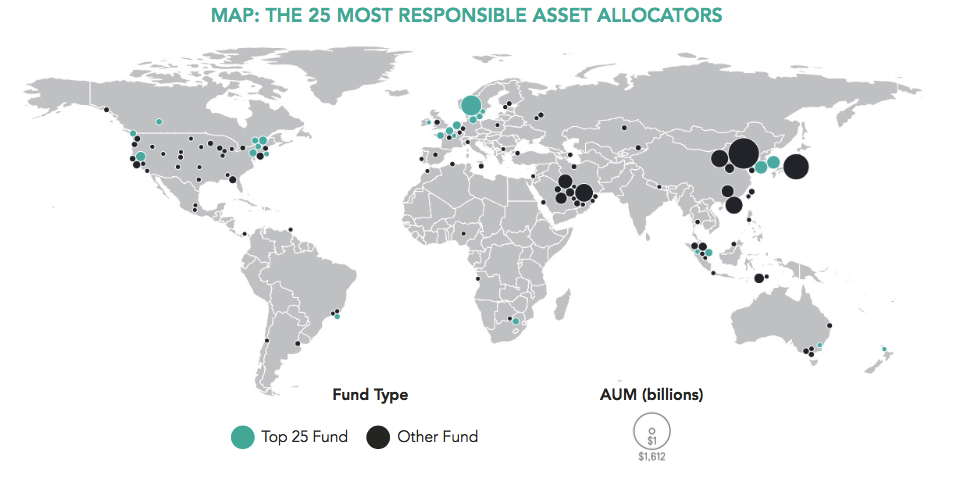

By focusing on a core group of SWFs and GPFs that are providing leadership on responsible investing practices, the Leaders List aims to jump-start investment by the broader community of asset allocators toward sustainability. Highlighting top performers from the peer group, based on clear and easy-to-understand guidelines, is an important first step toward encouraging greater adoption of responsible investment practices and ultimately toward mobilizing capital to support the Sustainable Development Goals.

By focusing on a core group of SWFs and GPFs that are providing leadership on responsible investing practices, the Leaders List aims to jump-start investment by the broader community of asset allocators toward sustainability. Highlighting top performers from the peer group, based on clear and easy-to-understand guidelines, is an important first step toward encouraging greater adoption of responsible investment practices and ultimately toward mobilizing capital to support the Sustainable Development Goals.

As stewards of long-term capital, the question is not whether large institutional investors can afford to integrate responsible investment practices into their portfolios but rather, can they afford not to.